Rolling ITM Options: AAPL Vertical Call Spread Case Study

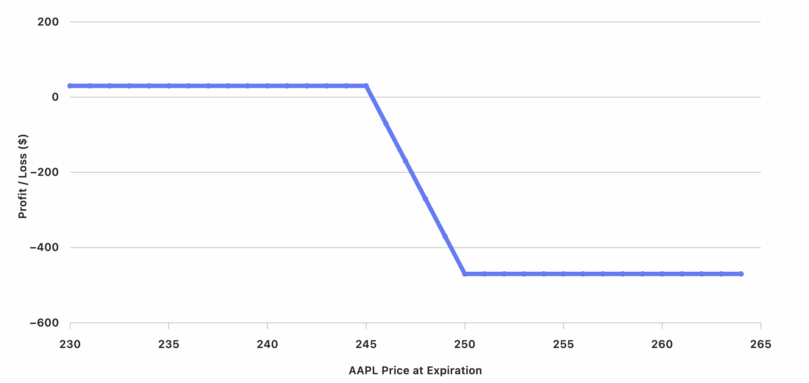

Managing options trades often requires flexibility. Rolling positions can help minimize losses and extend time for your thesis to play out. Let’s analyze a real-world example using Apple (AAPL). The Situation This roll moved the strikes deeper ITM and extended the expiration by three weeks. Updated Payoff Analysis For the new spread: Important Note:You also…